CanFirst IncomePlus Real Estate Fund (CIPREF)

Fund Details

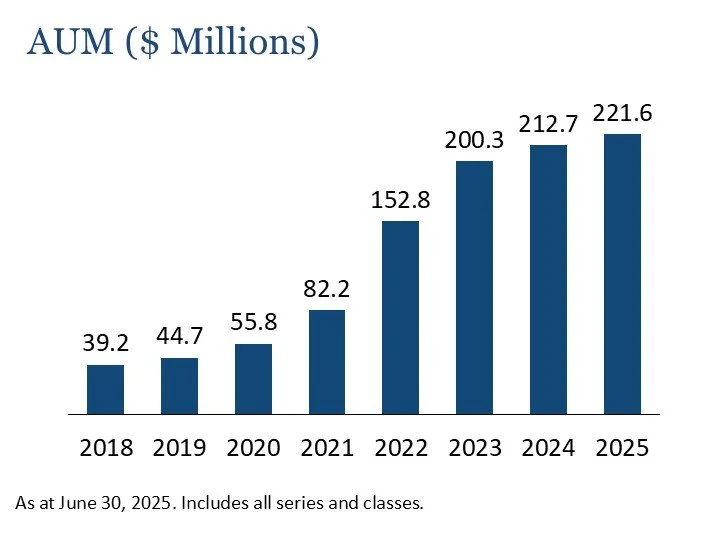

Created June 2018

Investing in Core and Core Plus Properties

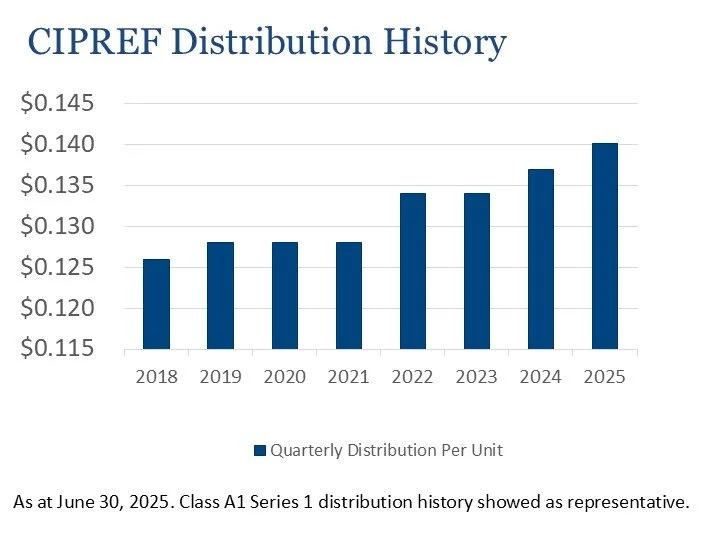

4%-6% Target Annual Distribution

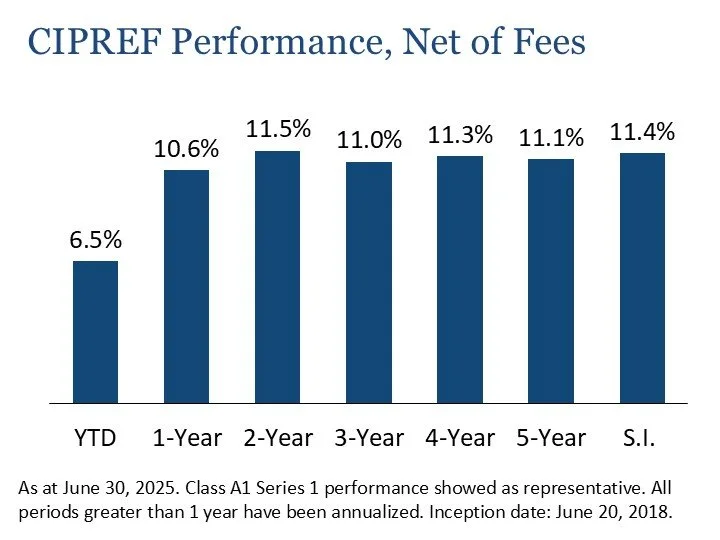

9%-10% Target Total Annual Return

Open-Ended Vehicle

Fund Objectives

To seek income, growth and capital preservation by investing in high quality commercial real estate

9-10% annual total return target, net of all fees

4-6% annual distribution target, paid quarterly as cash or re-invested units

Invest across Industrial, office, and retail properties with a focus on those that service the e-commerce and technology sectors

Why Invest?

The CanFirst Team has been trusted by institutional and HNW clients for over 19 years. Our value add experience allows us to extract top value in Core and Core Plus opportunities and we have a strong reputation for acquiring quality mid-size properties.

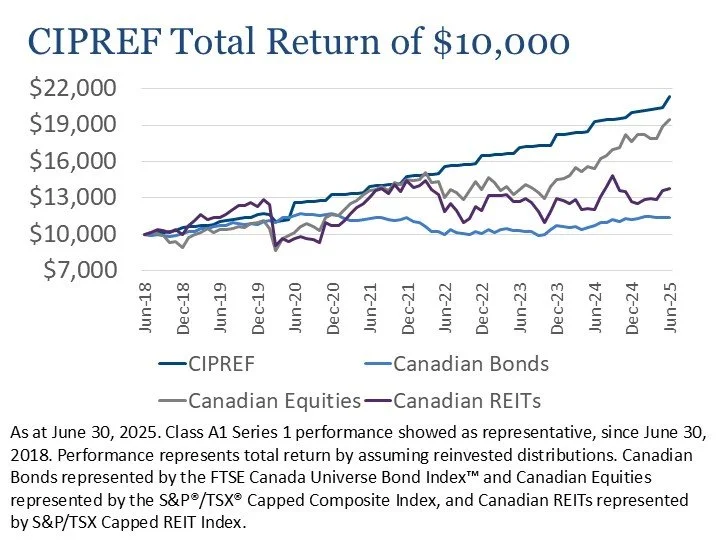

Low correlation to traditional asset classes

Pay yourself more with tax efficient distributions

Natural hedge against inflation

Lower risk than public equities